Dinosaurs and Pension Runs

Dinosaurs once roamed earth many years ago. They ruled for a time period then disappeared because of lack of sun, weather, or other unknown reasons. There are different opinions on why the dinosaurs disappeared. Although dinosaurs did rule earth, change happens unexpectedly. This can be seen with pensions and their risk.

Recent bank failures were unexpected by the crowd. Usually the crowd is wrong. The herd mentality of the crowd is to feel safe with what the crowd thinks. Group logic feels safe. How can the logic of a large crowd be wrong? In this case, the crowd was unprepared for the interest rate risk the banks were taking on. Instantly the crowds bank security diminished at a fast pace. The banks were unprepared for the rapid rise in interest rates even though they had all year to change the portfolio duration risk. Asleep at the wheel, the bank was unprepared for the savers running for the withdrawal exit. This unforeseen risk shifted perception of the banks FDIC safety.

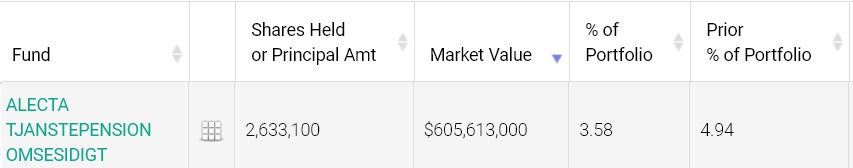

One of the most important things in Wall Street is transparency especially publicly traded assets vs private equity. A simple search of who owns shares in Silicon Bank can be found very easily. Its called 13F filings from the SEC. A simple search shows Swedish pension Alecta Tjanstepension Omsesidigt is the 4th largest share owner of Silicon Bank. Although pensions are large, a small position in the portfolio is risk. A retiree who annuitizes their pension doesn’t have any control on how the pension manages their money. Why take that risk? That risk can last 10, 20, 30 years before you’re dead. When you retire, you have 2 choices for your pension. You can take a lump sum or annuitize. Recently, the risk of being locked into a pension managing your pension is high. We already see banks that can’t figure out duration risk. At retirement a lump sum gives you the flexibility to manage your money according to your needs.

Like Silicon Bank, bank runs are when everyone heads for the exit at the same time. Pensions can have the same problem with troubled pensions1 and employees demanding lump sum payments at retirement. Why would you not take a lump sum payment? Why would you depend on the pension investing your money incorrectly for years ahead? We all see that the Silicon Valley winners in Silicon Bank were the savers that withdrew their money before FDIC came into action for depositors.

Things to remember: Crowds are often wrong. Transparency is good especially when pricing is shown in publicly traded markets. Always be first to the exit. A simple way to minimize these risks is to lump sum a pension when you have the opportunity. When lump summing a pension, don’t be a dinosaur. Talk to your Los Angeles financial advisor today.