The Cadillac of Life Insurance

Life insurance doesn't usually come up in everyday conversations until it suddenly does. One moment you’re scrolling through social media, and the next, you’re staring at a heartbreaking crowdfunding post for someone’s unexpected death. Usually it’s a family left behind with friends rallying to raise money to cover funeral costs. It’s a painful reminder of how fragile life can be and how unprepared many families are when tragedy strikes. But then there are those quiet stories, the ones we don’t always see in which everything was planned ahead. Where love meant protecting family even after you're gone. And for those who want to go above and beyond, layering a permanent life policy with a final expense plan isn’t just smart—it’s one of the most powerful, loving gifts you can leave behind. Lets explain the The Cadillac of Life Insurance further.

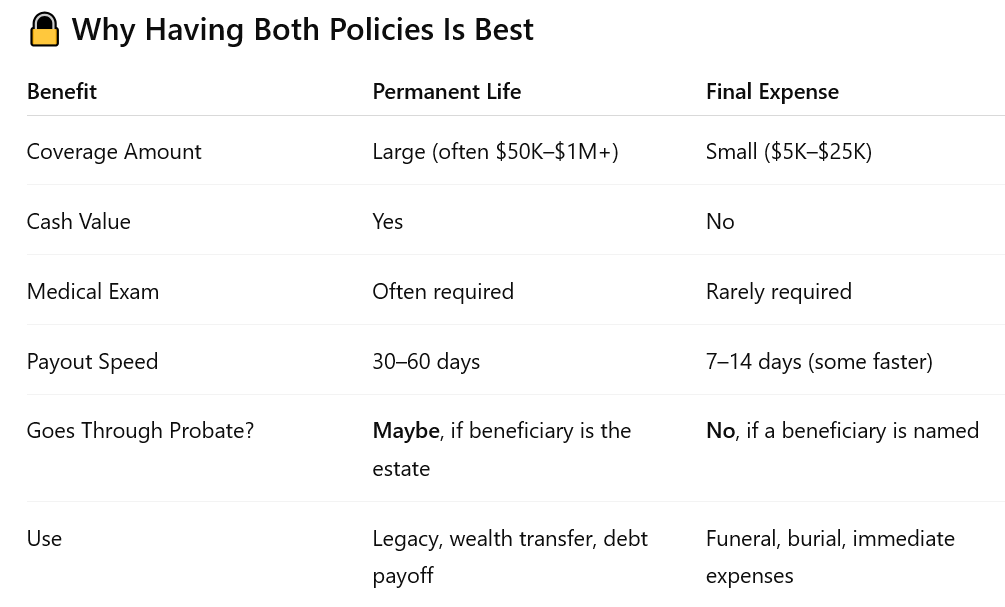

🛡️ Why Permanent Life Insurance and Final Expense Insurance Are Better Together

If you're thinking about protecting your legacy, your loved ones, and your final wishes—you're not just being smart, you're being strategic. There's a reason smart families, estate planners, and financially savvy retirees choose both a permanent life insurance policy and a final expense plan.

Let’s break down why—and show you the proof in the form of real U.S. statistics and timelines.

✅ Why Permanent Life Insurance Is So Valuable

1. Lifetime Coverage That Never Expires

Unlike term insurance, permanent life insurance (like whole life or universal life) provides lifetime protection—as long as you pay your premiums.

2. Cash Value You Can Use While Living

Grows tax-deferred

Can be used for emergencies, college, or retirement

You can borrow against it or even withdraw (with tax considerations)

3. Tax-Free Death Benefit

Your family receives a tax-free lump sum that can be used for anything—estate taxes, debts, or preserving wealth.

4. Living Benefits

Accelerated benefits that you can use while you are alive if met with qualifying conditions. Type of living benefits can be Long Term Care, Chronic Illness, or Critical Illness riders.

🕒 How Long Does Permanent Life Insurance Take to Pay Out?

According to the National Association of Insurance Commissioners (NAIC):

Most life insurance claims are paid within 30 to 60 days

Delays can happen if:

The insured passed away within the policy’s first 2 years (contestability period)

Cause of death is under investigation

There are issues with documentation

⚠️ But here's the catch:

If your estate is going through probate, some life insurance benefits may be delayed even further—unless your policy names specific individual beneficiaries (not just "the estate").

🏛️ How Long Does Probate Take in the U.S.?

Probate is the legal process of settling a person's estate after death. It includes validating a will, paying off debts, and distributing assets.

U.S. Probate Statistics:

Average probate process takes 6 to 12 months

In more complex cases, it can take 1 to 2 years or longer

During probate, many estate assets are frozen and inaccessible

That means:

If your family is relying on your estate to pay for final expenses or debts, they may have to wait months or years—unless you've planned ahead with the right insurance policies.

✅ Why Final Expense Insurance Is So Critical

Final expense insurance is a smaller, affordable policy ($5,000–$25,000) designed to cover:

Funeral and burial costs

Medical bills

Small debts

Immediate family needs

1. Easy to Qualify For

Most plans require no medical exam

Guaranteed or simplified issue available

Ideal for those 50–85+

2. Fast Access to Cash

Unlike assets in probate, final expense benefits are paid directly to your named beneficiary—fast and tax-free.

🕒 How Fast Does Final Expense Insurance Pay Out?

According to LIMRA and industry reports:

Most final expense policies pay within 7 to 14 days

Some companies offer 24–72 hour payouts once documentation is submitted

Your family can use these funds immediately—no waiting, no legal delays.

💡 Why This Matters for Your Estate and Family

If your estate goes into probate, your assets could be locked up for months or years

Your family may need to pay funeral homes, travel costs, medical bills, and debts long before the estate is settled

Having final expense insurance provides fast cash for those urgent costs

Having permanent life insurance builds long-term wealth for your loved ones

🚀 The Smartest Move: Get Both, and Sleep Better

✅ Permanent Life = Legacy & Wealth Transfer

✅ Final Expense = Speed & Financial Relief

Together, they give your family:

Security now

Security later

The ability to grieve in peace—not panic over money

Ready to Take Control of Your Legacy?

📞 Let me help you compare policies, rates, and get custom quotes tailored to your age and needs. The sooner you act, the better your rates and protection.

Protect your future. Protect your family. Own your legacy.

Copyright © 2024 All rights reserved. No part may be reproduced, altered, or copied in any form without written consent. Information contained herein is for informational purposes only and should not be construed as an offer, solicitation, or recommendation to buy or sell securities, personalized investment, tax or legal advice. The information has been obtained from sources believed to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the stocks they discuss. The information and content are subject to change without notice. Treveri Capital LLC is a California registered investment advisor. For information about Treveri Capital LLC’s, please consult the Firm’s Form ADV available at www.adviserinfo.sec.gov. CRPC®, Chartered Retirement Planning CounselorSM are trademarks or registered service marks of the College for Financial Planning in the United States and/or other countries. Disclaimer and privacy policy.