I Have $10 Million of Bitcoin & Crypto — What Do I Do Now?

Whale Decisions

A term known as “HODL” (Hold On for Dear Life) is very common among the crypto community. It’s a philosophy many Bitcoin and crypto investors have embraced, leading them to hold a coin for many years without selling. For some, this long-term commitment has resulted in millions of dollars in profits.

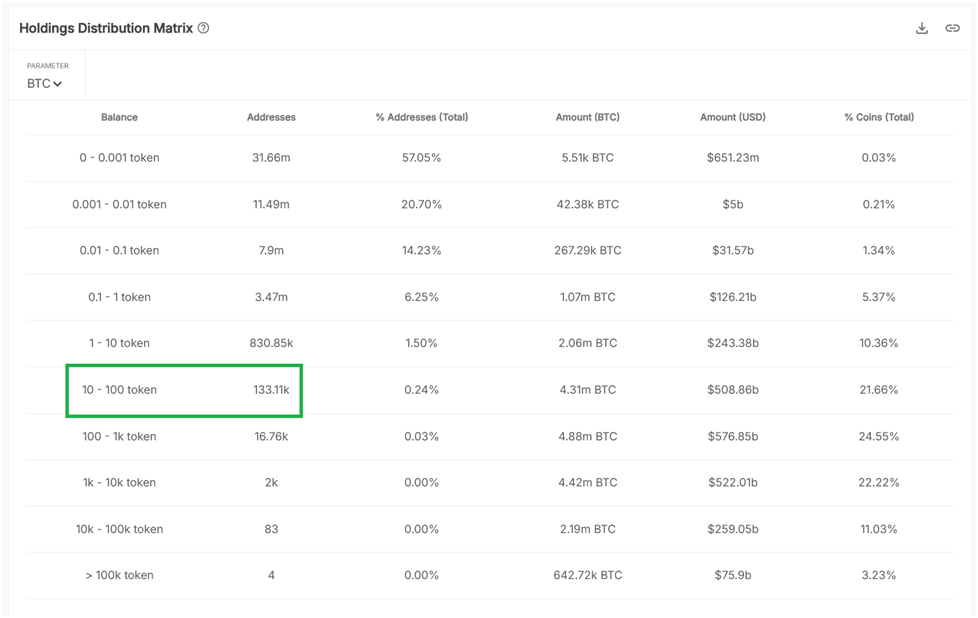

According to data from IntoTheBlock.com, there are roughly 133,000 Bitcoin wallet addresses holding 10 or more Bitcoins. Since some people may own multiple addresses, the actual number of individuals or entities with $10 million or more in Bitcoin might be closer to 100,000.

Everyone’s investment goals are different. If you’re a long-term holder who’s become a “crypto whale,” the next question is: What do you want to do with this new wealth? Your answer will shape how you manage your concentrated portfolio risk.

Top common ways to manage risk with a concentrated Bitcoin (or crypto) position:

Partial Diversification

Sell a portion of your holdings to buy other asset classes (stocks, bonds, real estate, private equity, precious metals, etc.) to reduce reliance on Bitcoin price swings.Use of Hedging Strategies

Employ derivatives such as futures, options, or structured products to protect against downside risk or lock in profits.Periodic Rebalancing

Establish target allocations (e.g., 50% crypto, 50% other assets) and adjust regularly to maintain your desired risk profile.Tax-efficient Selling

Strategically realize gains over several tax years, use tax-loss harvesting, or donate appreciated crypto to reduce tax burdens.Stablecoin Conversion

Convert part of your crypto holdings into stablecoins (like USDC or USDT) to lock in USD value while remaining in the crypto ecosystem.Earning Yield

Use reputable staking, lending, or DeFi platforms to generate passive income from your holdings—while understanding the additional risks involved.Private Investments and Tangible Assets

Allocate some wealth to hard assets like real estate, collectibles, or private businesses to diversify away from digital volatility.

Becoming a crypto whale is an incredible achievement — but with great wealth comes great responsibility. Holding a highly concentrated position in Bitcoin or any single crypto asset can create significant risk, especially in such a volatile market.

By exploring strategies like diversification, hedging, rebalancing, tax planning, and stablecoin conversion, you can reduce the impact of market swings and better protect the wealth you’ve worked so hard to build.

Ultimately, the goal isn’t just to hold on for dear life, but to make thoughtful, proactive decisions that turn your crypto gains into lasting financial security and a balanced portfolio for the future.

Copyright © 2024 All rights reserved. No part may be reproduced, altered, or copied in any form without written consent. Information contained herein is for informational purposes only and should not be construed as an offer, solicitation, or recommendation to buy or sell securities, personalized investment, tax or legal advice. The information has been obtained from sources believed to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the stocks they discuss. The information and content are subject to change without notice. Treveri Capital LLC is a California registered investment advisor. For information about Treveri Capital LLC’s, please consult the Firm’s Form ADV available at www.adviserinfo.sec.gov. CRPC®, Chartered Retirement Planning CounselorSM are trademarks or registered service marks of the College for Financial Planning in the United States and/or other countries. Disclaimer and privacy policy.