Bank You

The Trusted Trusted Bank

With hyper inflation and high interest rates, it's a good time to bank on yourself. It’s almost weekly that we see prices in the grocery store going up on produce or various concert tickets selling for $300 bucks with a $75 service fee. In this ever changing economic environment, how do you bank on yourself?

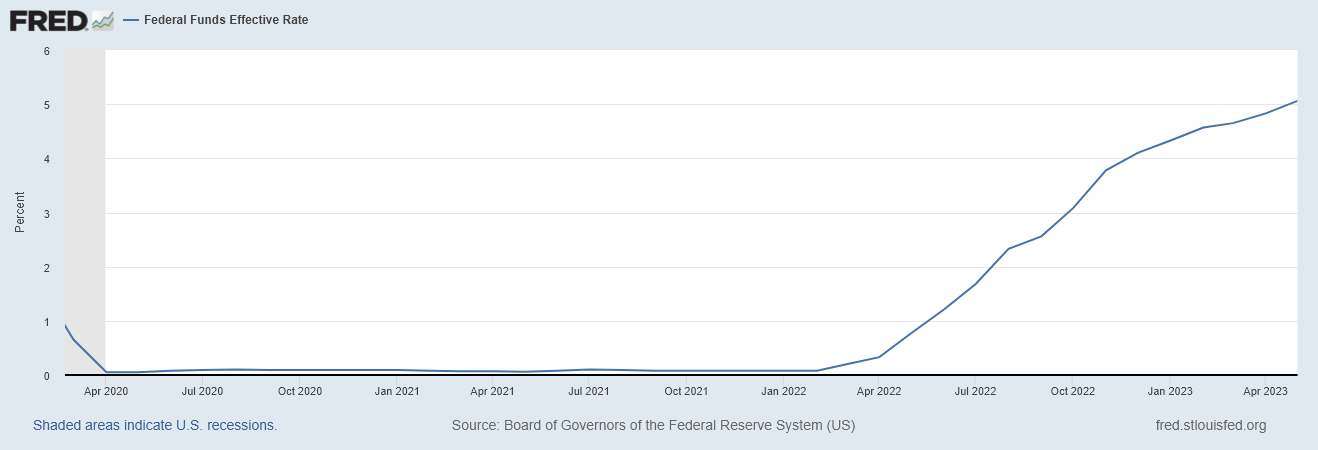

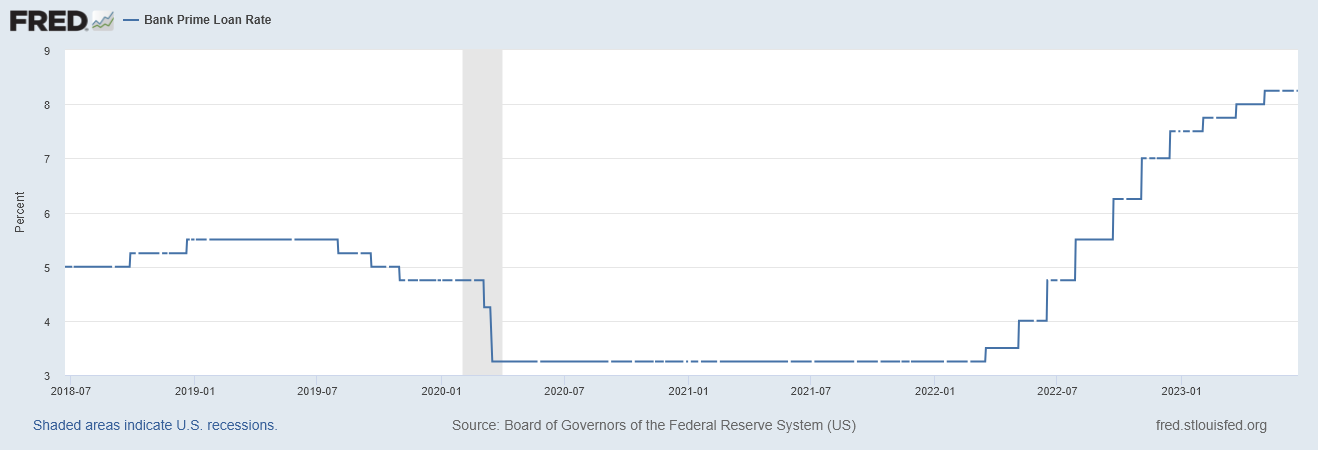

In an environment of high interest rates ie.. hyper inflation, it's important to review what financial accounts you have. If they're variable such as a typical 2nd mortgage known as a home equity line of credit (HELOC) or a credit card, it's floating with the Fed Funds interest rates hikes and prime rate. This can be expensive.

What to do? Pay it down as fast as you can. Sometimes they're needed for cash flow reasons. But, unless you're generating rates of returns higher than 10-20%+ annually it's kind of pointless having these accounts because these are high costs.

By paying off high interest debt, you can concentrate of putting money to work on other investments. Sure we would all like to make 20%+ returns on unsecured credit card debt but if you're paying high rates, it's important to pay those debts off first before investing in other higher yielding assets.

In a hyper inflation world many assets go up in value. Why? Because prices go up which in turn reflect in sales and earnings of a business. In high inflationary environments, technologically oriented businesses that become very efficient by using the latest technologies such as AI can eventually blow out earnings forecasts with less overhead. Technology can become disruptive and actually become deflationary to businesses when used correctly. We currently are seeing this with AI, Web3 and the many possibilities being used in media, film, and software programming. Think writer strikes in Hollywood that continue…

Before investing in the latest trends, review your debt and pay down high interest rate debts. Once that's paid down, look for high yielding possibilities. Need help, talk with our financial advisors at Treveri Capital..